Maitake Supplements: A Quantitative Analysis of the U.S. Market

Maitake Supplements: A Quantitative Analysis of the U.S. Market

Executive Summary: A Statistical Snapshot of the Maitake Supplement Market

Maitake mushroom (Grifola frondosa), often called 'Hen of the Woods', has transitioned from a culinary delicacy to a prominent ingredient in the dietary supplement aisle. While many discussions focus on its potential health benefits, this article takes a different, evidence-based approach. We provide a purely quantitative analysis of the U.S. Maitake supplement market. This report is not a guide to health benefits or a recommendation of any product; it is a statistical breakdown intended to provide consumers with objective, data-driven insights into what is actually being sold.

Our analysis is derived from a dataset of 31 distinct Maitake-containing supplement products available to U.S. consumers. We have systematically cataloged and analyzed each product's price, serving size, dosage, supplement form, ingredient source, and common co-ingredients to paint a clear picture of the market landscape. This article translates our raw data into understandable trends, averages, and distributions. The goal is to empower you, the consumer, with a baseline understanding of this specific supplement category, helping you to evaluate products based on objective market data rather than marketing claims alone.

Here is a high-level overview of our key findings:

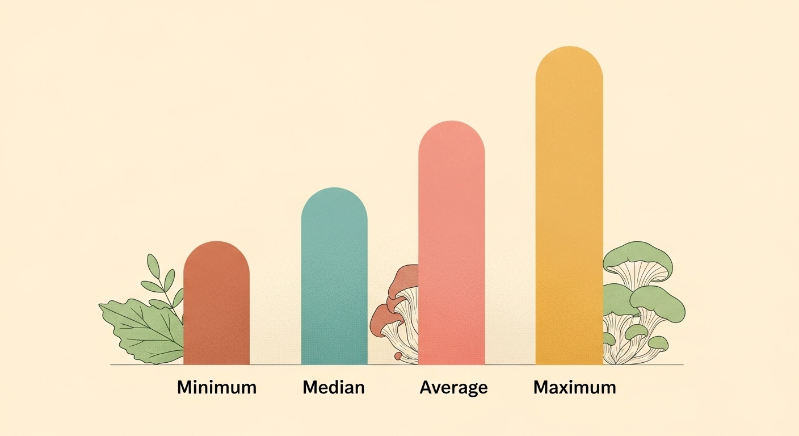

Price per Serving: The cost for a single serving of a Maitake-containing supplement varies widely. The median price per serving across all 31 products is $0.56. The average price is slightly higher at $0.65, with the full range spanning from a highly economical $0.07 to a premium $1.83 per serving.

Dosage of Maitake: The amount of Maitake per serving is highly variable, largely dependent on whether it is the star ingredient or part of a larger blend. The median dosage is 125 mg per serving. The average is 153.5 mg, but this figure is skewed by numerous low-dose blends. Dosages range from as little as 5 mg to as much as 640 mg.

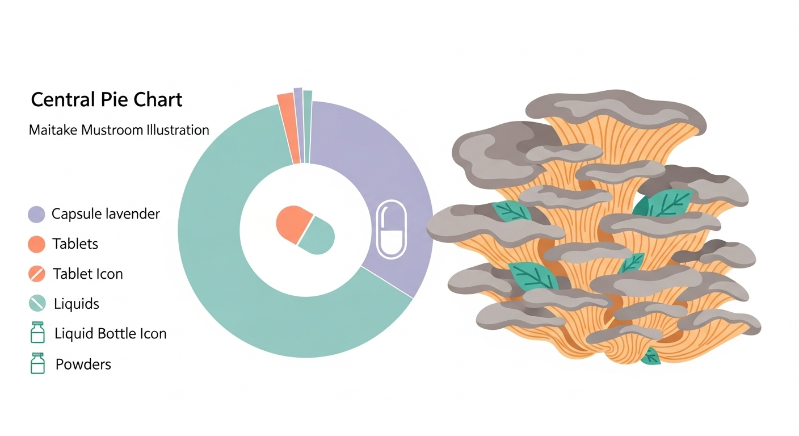

Dominant Supplement Form: Capsules are the undisputed market leader for Maitake delivery. Our analysis shows that 51.6% of products are sold as capsules (including traditional capsules, VegCaps, and softgels). Tablets and wafers represent the second-largest segment at 29.0%.

Common Ingredient Source: The specific part of the mushroom used is a key differentiator. Products using extracts from the mushroom's fruiting body are the most common single category, accounting for 29.0% of the market. However, products using mycelium grown on grain are also a significant segment, representing 25.8% of the analyzed supplements. This distinction is a critical point of debate and marketing within the industry.

Popular Ingredient Pairings: Maitake is frequently sold as part of a multi-ingredient formula, often with other medicinal mushrooms. The most common co-ingredient is Reishi mushroom, found in 51.6% (16 out of 31) of the products. Shiitake mushroom is a close second, appearing in 48.4% of products. Vitamin C is the most common non-mushroom pairing, included in 38.7% of supplements.

About Our Market Data and Methodology

To ensure our analysis is both trustworthy and authoritative, it is crucial to understand the foundation of our data. This report is built upon a detailed dataset comprising 31 unique Maitake mushroom supplement products sold by various retailers in the United States. Our methodology is systematic and objective, focused on capturing the precise information presented to consumers on the product label and supplement facts panel.

For each of the 31 products, we collected and verified key data points, including: total price, number of servings per container, the supplement's physical form (e.g., capsule, liquid), and a complete list of active ingredients with their respective quantities and forms. All statistics, averages, percentages, and insights presented in this article are derived exclusively from the mathematical analysis of this curated dataset. We do not incorporate marketing claims or anecdotal evidence; every number is rooted in the product data itself.

We recognize that the supplement market is dynamic. Formulations change, new products are launched, and prices fluctuate. To maintain the relevance and accuracy of our analyses, we are committed to periodically updating our datasets. The data presented in this specific article reflects our most recent data refresh. By adhering to this rigorous, data-first methodology, we aim to provide a reliable and unbiased snapshot of the market, offering a clear view of the trends shaping the Maitake supplement category today.

Comprehensive Price Analysis: The Cost of Maitake Supplements

Price is a fundamental consideration for consumers. Our analysis of 31 products reveals a significant spectrum in the cost of Maitake supplements. Understanding this spectrum requires looking beyond the shelf price and examining the more informative metric of price per serving.

Overall Market Pricing: Package vs. Per-Serving Cost

The total package price—what you pay at checkout—can be misleading due to vast differences in the number of servings per container. In our dataset, the price for a single bottle or package ranged from a low of $6.99 to a high of $69.09. The average package price was $26.28, with a median price of $22.99.

A more standardized and useful metric is the price per serving. This allows for a direct comparison of value between products of different sizes. Our analysis found that the average cost per serving across all 31 products is $0.65. The median cost is lower at $0.56, suggesting that a few high-priced premium products pull the average up. The full range is quite dramatic, spanning from just $0.07 per serving for a bulk powder product to $1.83 per serving for a high-potency, multi-ingredient formula. This more than 25-fold difference highlights the incredible diversity in market positioning.

Price Breakdown by Supplement Form

The physical form of a supplement often correlates with its price point due to different manufacturing costs and consumer expectations. We segmented our price-per-serving data by the four main delivery formats found in our dataset.

Capsules and Tablets: As the largest segments of the market, capsules and tablets have very similar pricing structures. The 16 capsule-based products had a median price per serving of $0.80. The 9 tablet-based products were slightly more affordable, with a median price per serving of $0.31. The lower cost for tablets is influenced by several high-serving-count, lower-cost immune blend products in our dataset.

Powders: The two powder-based products in our analysis offered significant value, with a median price per serving of just $0.53. This is typical for powdered supplements, as they often come in larger containers and eliminate the costs associated with encapsulation or tablet pressing, offering better value for consumers who do not mind measuring out their own doses.

Liquids: The four liquid extracts or tinctures in our dataset represent the most premium category. The median price per serving for liquid Maitake supplements was $0.21. However, this number is deceiving as three of the four liquid products were from a single value-oriented brand. The fourth, a high-potency professional-grade extract, had a price per serving of $0.22, but with a much higher concentration. Generally, liquid extracts are perceived as a premium format, but the data shows value options are available.

Price and dosage are not always directly correlated. Some of the most expensive products per serving contain relatively low doses of Maitake, as their price is driven by other premium ingredients in the formula. Conversely, some of the most affordable products offer a substantial dose, particularly those in powder form.

Deep Dive into Dosage and Potency

The amount of active ingredient per serving is arguably the most critical factor after safety. For Maitake supplements, the dosage landscape is complex and requires careful interpretation. A simple average does not tell the whole story, as dosages are heavily influenced by the product's formulation strategy—whether Maitake is the primary ingredient or a small part of a broad-spectrum blend.src01src06

The Overall Dosage Landscape: A Tale of Two Product Types

Across all 31 products, the Maitake dosage per serving ranges from a minuscule 5 mg to a robust 640 mg. The average dosage is 153.5 mg, and the median is 125 mg. These numbers, on their own, are misleadingly low. They are heavily skewed downward by the large number of multi-ingredient 'immune-support' or 'mushroom-complex' formulas where Maitake is just one of a dozen or more components.

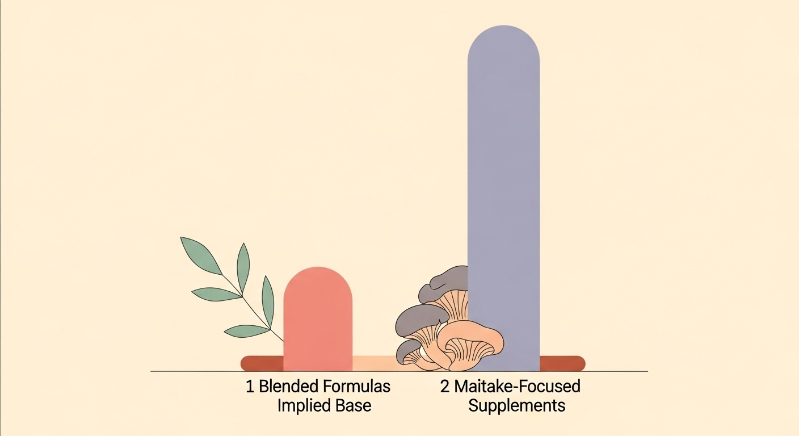

To provide a more meaningful analysis, we must segment the products into two distinct categories:

- Maitake-Focused Products: These are supplements where Maitake is the primary active ingredient. This category includes products that are either 100% Maitake or feature it as the most prominent component. In our dataset, 8 products fit this description. For this group, the average dosage skyrockets to 374 mg per serving, with a median of 450 mg. This is a much more realistic representation of a standard dose when one is specifically seeking a Maitake supplement.

- Blended Formulas: This category includes products where Maitake is part of a larger proprietary blend, often with other mushrooms, vitamins, and herbs. 23 products in our dataset fall into this category. Here, the average Maitake dosage is significantly lower, at just 92 mg per serving, with a median of 100 mg. Consumers buying these products are not getting a primary Maitake supplement, but rather a formula that includes Maitake as part of a synergistic or 'shotgun' approach.

Beyond Milligrams: Potency, Extracts, and Standardization

Dosage in milligrams is not the only measure of a supplement's potential. Potency, especially in the context of mushroom supplements, is a critical factor. The primary bioactive compounds in Maitake responsible for many of its studied effects are polysaccharides, particularly a unique class of beta-glucans. Research has heavily focused on these compounds for their immunomodulatory properties. Consequently, the form of the Maitake ingredient—raw powder versus a concentrated extract—can be more important than the raw milligram count.

An extract is a concentrated form of the mushroom. Manufacturers use a solvent (commonly hot water or alcohol) to pull out specific compounds, resulting in a product that is more potent on a weight-for-weight basis. Some products specify an extraction ratio, like 4:1, meaning 4 kilograms of raw mushroom were used to create 1 kilogram of extract. None of the products in our dataset specified a ratio.

A more precise method is standardization. This involves creating an extract that is guaranteed to contain a certain percentage of a specific bioactive compound. In our dataset, we found two primary types of standardization claims related to Maitake:

- D-Fraction: Several products from the brand Mushroom Wisdom feature their proprietary, standardized Maitake extract known as D-Fraction. This is a specific, well-researched proteoglycan (a protein bound to a beta-glucan) that has been the subject of numerous studies. The dosage of D-Fraction in these products ranges from 18.3 mg to 120 mg, but this represents a highly concentrated and purified component, not just ground mushroom.

- Polysaccharides: Other products, like one from Nature's Way, are standardized to a certain percentage of polysaccharides. This is a broader standardization but still indicates a concentrated extract designed to deliver the key active compounds.

It is crucial for consumers to understand this distinction. A 50 mg dose of a standardized, potent extract like D-Fraction is not comparable to a 500 mg dose of un-extracted, whole mushroom powder. The former delivers a guaranteed amount of a specific bioactive compound, while the latter provides the full spectrum of the mushroom in its natural, but less concentrated, state.

Formulation and Delivery: A Market Analysis

How a supplement is delivered and what it is made from are critical aspects of its design and marketing. Our analysis reveals clear trends in the physical forms of Maitake supplements and, more importantly, in the part of the mushroom used to make them—a topic of significant debate among experts and brands.src02src03

Market Share by Supplement Form: The Dominance of Capsules

When it comes to how consumers take their Maitake, convenience is king. Capsules are the overwhelmingly dominant format.

Our data shows the following market share distribution by form:

- Capsules (including VegCaps, Softgels): 51.6% (16 of 31 products). This form offers convenience, tasteless delivery, and precise, pre-measured doses, making it the top choice for a majority of brands and consumers.

- Tablets (including Wafers): 29.0% (9 of 31 products). Tablets share many of the benefits of capsules but may contain more binding and filling agents. This category also includes chewable wafers, which are used for children's formulas.

- Liquids (Extracts/Tinctures): 12.9% (4 of 31 products). Liquid extracts are often preferred for their potential for faster absorption and ease of administration for those who dislike swallowing pills. Dosing can also be easily customized by varying the number of drops.

- Powders: 6.5% (2 of 31 products). Though a small segment, powders offer the greatest dosage flexibility and are often the most cost-effective option. They can be mixed into smoothies, coffee, or other foods, but require the user to measure their own dose.

The Great Debate: Fruiting Body vs. Mycelium

Perhaps the most significant differentiator in the mushroom supplement world is the part of the fungus used. This is a topic with passionate arguments from both sides.

The fruiting body is the part of the mushroom that you would recognize and eat—the cap and stem that grow above ground. Proponents of using the fruiting body argue that it is the part that has been used traditionally for centuries and that it contains the highest concentration of the desired bioactive compounds, like beta-glucans. Scientific literature comparing the two parts often finds higher concentrations of key active components in the fruiting body.

The mycelium is the root-like network of the fungus that grows beneath the surface. In commercial production, mycelium is often grown in a sterile lab environment on a grain substrate like brown rice or oats. The final product, often called 'myceliated grain' or 'mycelial biomass', contains both the mycelium and the residual grain it was grown on. Brands that use this method argue that the mycelium produces its own unique set of beneficial compounds (like extracellular compounds secreted into the grain) and that lab cultivation ensures purity and consistency.

Our analysis of the 31 products reveals a market nearly evenly split between these two philosophies:

- Mycelium / Myceliated Grain: 25.8% (8 of 31 products) explicitly use mycelium or fermented grain as their source. The Host Defense and ZHOU brands are prominent examples in our dataset that utilize this method.

- Fruiting Body: 38.7% (12 of 31 products) explicitly state they use the fruiting body, either as a powder or an extract. This includes the three products from Mushroom Wisdom that use a combination of fruiting body powder and extract.

- Unspecified: A significant portion, 35.5% (11 of 31 products), do not specify which part of the mushroom is used. They simply list "Maitake Mushroom" or "Maitake Mushroom Extract." In these cases, consumers cannot be certain about the source of the ingredient without contacting the manufacturer.

The 'Fruiting Body vs. Mycelium' debate is a crucial factor for informed consumers. The choice impacts the chemical profile of the final product. Neither is inherently 'bad', but they are different, and the science suggests fruiting bodies often have higher concentrations of beta-glucans, while mycelium may have other unique compounds.

src03The Company Maitake Keeps: An Analysis of Common Co-Ingredients

Maitake is often not a solo act. A large portion of the market consists of multi-ingredient formulas designed to provide broad-spectrum support, typically for the immune system. Analyzing the ingredients most frequently paired with Maitake reveals key formulation trends and product categories.

The Mushroom Entourage: Multi-Mushroom Blends

The most common partners for Maitake are other well-known medicinal mushrooms. The data shows a strong trend towards creating comprehensive mushroom complexes that offer a variety of bioactive compounds from different species. These products are often marketed for general wellness and adaptogenic support.

The top 5 mushroom co-ingredients found in our dataset are:

- Reishi (Ganoderma lucidum): The most common partner, appearing in 51.6% (16 of 31) of products. Reishi is prized for its calming and adaptogenic properties.

- Shiitake (Lentinula edodes): A very close second, found in 48.4% (15 of 31) of products. Shiitake is another culinary and medicinal mushroom known for its immune-supporting polysaccharides.

- Chaga (Inonotus obliquus): Included in 35.5% (11 of 31) of products. Chaga is rich in antioxidants and is a staple in many mushroom blends.

- Lion's Mane (Hericium erinaceus): Also present in 35.5% (11 of 31) of products. Lion's Mane is unique in these blends for its association with cognitive and neurological health.

- Cordyceps (Cordyceps militaris/sinensis): Found in 32.3% (10 of 31) of products. Cordyceps is typically included for its reputation in supporting energy and athletic performance.

The Immune Support Stack: Vitamins, Minerals, and Herbs

Beyond other fungi, Maitake is frequently formulated into classic 'immune support' stacks alongside well-established vitamins, minerals, and herbs. This strategy aims to create a comprehensive, multi-action product that leverages the reputation of these traditional immune-support ingredients.

The most common non-mushroom pairings are:

- Vitamin C: The number one non-mushroom co-ingredient, found in 38.7% (12 of 31) of products. It's a foundational nutrient for immune health and is also an antioxidant.

- Zinc: Included in 29.0% (9 of 31) of supplements. Zinc is another critical mineral for immune cell function, making it a logical addition to these formulas.

- Astragalus Root: An adaptogenic herb from Traditional Chinese Medicine, Astragalus is found in 25.8% (8 of 31) of products, often alongside Echinacea.

- Echinacea: One of the most popular Western herbs for immune support, Echinacea appears in 22.6% (7 of 31) of the analyzed products.

This data shows that a substantial portion of the market positions Maitake not as a standalone ingredient but as a key component in a broader immune-health or general wellness strategy, combining it with other ingredients that consumers already associate with those benefits.

Frequently Asked Questions About the Maitake Supplement Market

Statistically, the most typical product is a capsule containing 100-150 mg of Maitake as part of a multi-mushroom blend that also includes Reishi and Shiitake. This capsule would likely be part of a 30 or 60-serving bottle and cost around $0.50 to $0.80 per serving.

The primary reason is formulation strategy. Products designed as 'Maitake-focused' supplements have a much higher average dose (around 374 mg). Products that are broad 'immune blends' or 'mushroom complexes' use Maitake as one of many ingredients, resulting in a much lower average dose (around 92 mg). Additionally, the use of highly concentrated extracts (like D-Fraction) requires a lower milligram dosage compared to using whole, un-extracted mushroom powder.

Based on our analysis, products explicitly stating they use the fruiting body (38.7%) are slightly more common than those stating they use mycelium (25.8%). However, a very large portion of the market (35.5%) does not specify which part is used, making it difficult for consumers to know for sure without further research into the brand.

According to our data, powdered forms tend to be the most cost-effective on a per-serving basis, with a median price of $0.53. High-potency, multi-ingredient capsules and tablets represent the more premium end of the market, with some products costing up to $1.83 per serving. The absolute cheapest per-serving option in our dataset was $0.07, while the most expensive was $1.83.

While the concept of extracts is common, extracts standardized to a specific bioactive compound are a minority in the market. In our dataset of 31 products, 7 products (22.6%) from two brands (Mushroom Wisdom and Nature's Way) made specific standardization claims, either for the proprietary D-Fraction or for a general percentage of polysaccharides. This indicates that while it's a key feature for some scientifically-focused brands, it is not yet a market-wide standard.

Conclusion and Final Verdict on the Market

Our quantitative analysis of 31 Maitake mushroom supplements reveals a complex and highly segmented market. It is not a monolith but rather a collection of distinct product philosophies. There is no single 'standard' product, but rather several archetypes catering to different consumer needs and beliefs. We see the high-dose, Maitake-focused products for purists; the multi-mushroom complexes for general wellness enthusiasts; the low-dose immune blends leveraging the mushroom's reputation alongside vitamins; and the scientifically-positioned, standardized extracts for those seeking a specific bioactive compound.

The data provides a clear, objective lens through which to view this landscape. The median price per serving of $0.56 provides a value benchmark. The dominance of capsules (51.6%) speaks to consumer demand for convenience. The sharp divide between fruiting body and mycelium-based products highlights a fundamental, ongoing debate within the industry that consumers must navigate. Perhaps most critically, the vast range in dosage (5 mg to 640 mg) underscores the absolute necessity of reading the supplement facts panel carefully and understanding whether a product is a potent, focused formula or a diluted blend.

Ultimately, the Maitake supplement market is mature enough to offer a wide array of choices. This analysis is not intended to steer consumers toward one choice over another but to equip them with the statistical data needed to make an informed decision that aligns with their personal health philosophy and budget. By understanding the market averages, the formulation trends, and the key differentiators, consumers can more effectively discern value and suitability in a crowded supplement aisle.

Summary of Key Statistical Findings

Median Price Per Serving: $0.56

Average Price Per Serving: $0.65

Price Per Serving Range: $0.07 to $1.83

Median Maitake Dosage (All Products): 125 mg

Average Maitake Dosage (Maitake-Focused Products Only): 374 mg

Most Common Supplement Form: Capsules (51.6% of market)

Most Common Mushroom Co-Ingredient: Reishi (in 51.6% of products)

Most Common Non-Mushroom Co-Ingredient: Vitamin C (in 38.7% of products)

Prevalence of Mycelium-Based Products: 25.8%

Prevalence of Fruiting Body-Based Products: 38.7%

Sources

- Grifola frondosa (Maitake): A Comprehensive Review on its Health-Promoting Properties, Uses, and Future Prospects (2021) — link [Journal Article]

src01 - Maitake D-Fraction, a Natural Mushroom Extract, Induces Apoptosis in Breast Cancer Cells by an Original Pathway (2011) — link [Journal Article]

src02 - A comparative study on the main active components of the fruiting bodies and mycelia of G. frondosa (2016) — link [Journal Article]

src03 - Maitake mushroom (Grifola frondosa) extract induces ovulation in patients with polycystic ovary syndrome: a possible monotherapy and a combination therapy after failure with clomiphene citrate (2010) — link [Journal Article]

src04 - The Therapeutic Effects of Grifola frondosa (Maitake) Mushroom in People with Type 2 Diabetes (2012) — link [Journal Article]

src05 - Immunomodulatory properties of medicinal mushrooms: a review (2014) — link [Journal Article]

src06